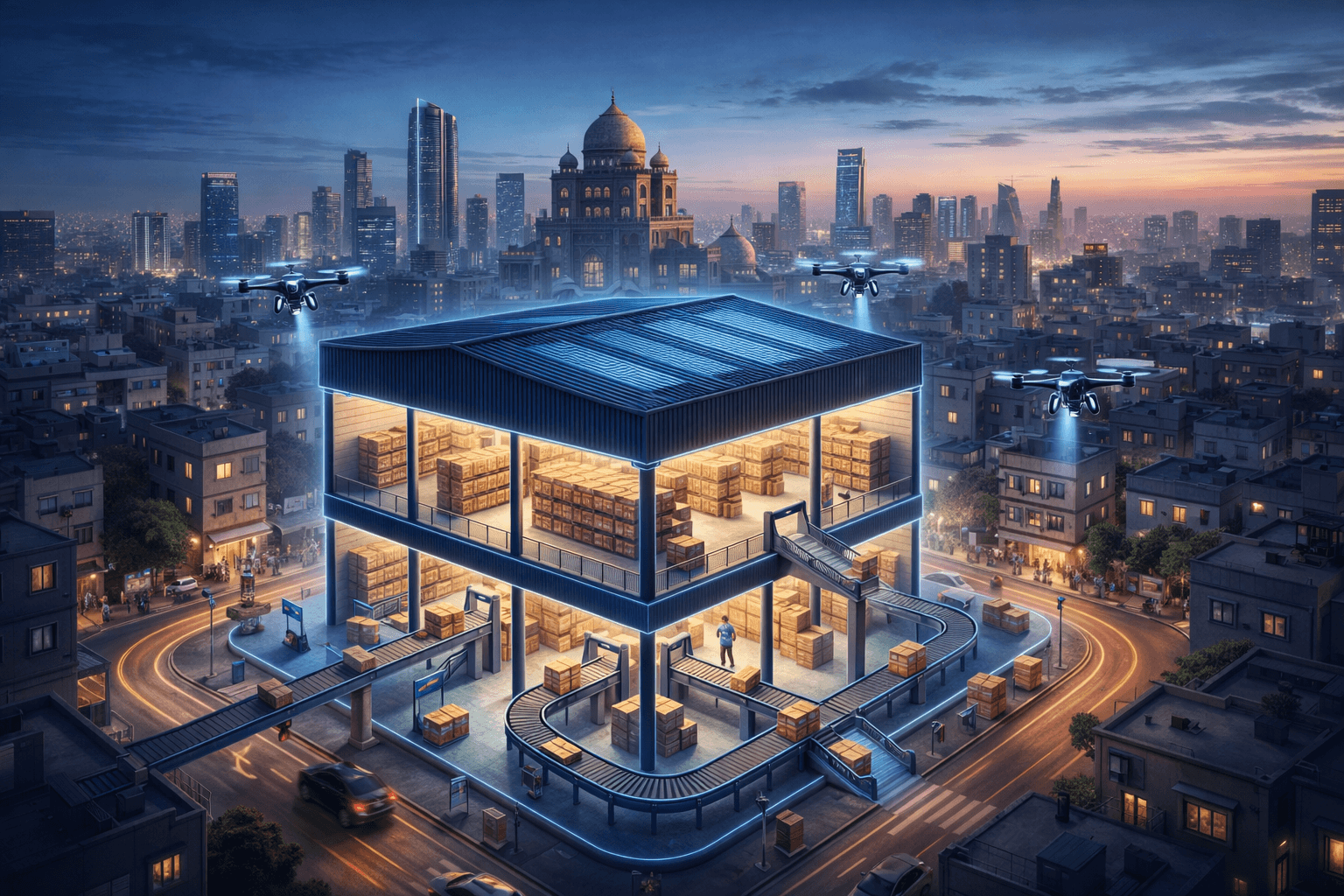

In the year 2024, Q-commerce (Quick Commerce) was (and currently still is) about providing delivery of your milk within a 10-minute timeframe. By 2026, it’s now about providing a complete ‘ecosystem for delivery’. The industry’s transformation from temporary, disordered ‘dark stores’, through ‘megapods’, illustrates the substantial shift in consumer demand and requires this transition due to the harsh economic realities associated with unit economics.

Thus, for the technical founder/investor community, this story relates to the increase in density and not the speed. Below provides a breakdown of some of the architectural and economic elements of the 2026 Quick Commerce model.

The Engineering of a “Megapod”

The average dark store has grown in size from a small 3,000 sq. ft. to a medium/large 8,000-12,000+ sq. ft. as of 2026. Furthermore, this is much more than just an increase in size; it represents a completely different way of thinking about how to manage fulfilment.

- SKU Explosion: Megapods are expected to hold more than 50,000 SKUs, which is an increase from the 4,000 SKUs that most dark stores currently accommodate. This is significant because many of these SKUs will be taking on high-value electronics (i.e., iPhone 17, air purifiers) and beauty products—all of which can easily provide margins that are 4x higher than those of grocery items.

- The “Pick-to-Light” Tech Stack: Due to the necessity of maintaining speed while handling 10x the amount of inventory, workers no longer have to memorise the layout of the dark store; instead, a Pick-to-Light (PTL) System will allow LED lights that are located on the racks to illuminate as guidance for the workers.

- Metrics: The average amount of time spent picking for a basket containing 5 items has been reduced to less than 120 seconds, within a building of approximately 10,000 sq. ft.

- Predictive Replenishment: With the implementation of 2026-style predictive engineering, inventory will no longer be replenished based solely upon what was sold within the previous 24 hours; Instead, inventory will be replenished based upon highly localised unexpected triggering events (i.e., a cricket match is scheduled to start in 1 hour = increased stock of chips and beer at specific pin codes).

Unit Economics: The Profitability Gap (Metro vs. Tier-2)

The “Megapod” model works beautifully in Mumbai or Bangalore. In Jaipur or Lucknow, the math breaks.

The 2026 Cost Structure (Per Order Estimates):

| Metric | Tier-1 Metro (Mature) | Tier-2 City (Growth) |

|---|---|---|

| Average Order Value (AOV) | ₹709 (Premium Mix) | ₹210 (Essentials Only) |

| Delivery Cost | ₹45–47 | ₹35–40 |

| Dark Store Ops Cost | ₹40 | ₹30 |

| Marketing/CAC | ₹50 (Retained User) | ₹250+ (New User) |

| Contribution Margin | Positive (+₹15-20) | Negative (-₹40) |

| Breakeven Volume | ~1,200 Orders/Day | ~850 Orders/Day (Struggling) |

- The Tier-2 Trap: In non-metros, 63% of orders are driven by promo codes, and the basket is dominated by low-margin FMCG (Maggi, Milk). The AOV of ₹210 is insufficient to cover the fixed logistics cost of ₹75 (Delivery + Ops).

- The Metro “Gold Mine”: In Metros, the high AOV (driven by electronics and beauty) allows the platform to absorb delivery costs and still net a positive contribution margin

New Revenue Opportunities: Retail Media Growth

Delivery fees have become irrelevant. The major revenue source for platforms in 2026 is Retail Media Advertising.

- Brands pay a tax, or rent, to be featured in the search results, which is known as the “Search Tax.” In-app search sponsorships and banner ads now account for 10% –15% of total revenue for platforms such as Blinkit and Zepto.

- Private Labels are now being favourably considered versus national brands. For instance, Surf Excel yields a 10% margin when sold by the platform, but the platform’s private label detergent yields a 40% margin. Platforms are focusing heavily on private Labels in search algorithm results, as it greatly improves blended margins.

Regulatory Impact on Gig Workers

January of 2026 marked the end of the “10-Minute Delivery” claim by virtue of regulation and strikes by gig workers.

- The Safety Tax is a result of new labor laws that require social security contributions (insurance & employee provident fund contributions) to be made by platforms on behalf of gig workers. This will increase the platform’s cost base by approximately ₹1.50 – ₹2.50 per order.

- All or portions of the additional cost incurred by the platform will have to be passed on to consumers. Consequently, expect the minimum delivery fee to stabilize at around ₹25 – ₹30, thus ending the era of “free delivery” subsidy programs.

The Resolution: Big Business Decimates Each Other

Amazon’s and Flipkart’s hold over India continues to fade away by 2026 as a consequence of long-term trends.

“Impulse” Resettling: A trimmer or mixer-grinder were historically a “planned purchase” (2-day delivery time) – but now, thanks to mega-pods, they’re interchangeable with “impulse purchases” (15-minute window).

Quick commerce will grow to $6.6 Billion by 2031, with huge reductions in the potential for future “planned” e-commerce sales.